Progreso Insurance: A Comprehensive Overview

In the dynamic world of insurance, Progreso Insurance stands out as a provider dedicated to meeting the diverse needs of its customers, particularly within the Hispanic community. With a focus on accessibility, affordability, and personalized service, Progreso Insurance has carved a niche for itself in the competitive insurance market. This article delves into the history, products, services, customer experience, and overall impact of Progreso Insurance.

History and Background

Progreso Insurance emerged with a clear mission: to provide accessible and affordable insurance solutions to underserved communities. Recognizing the unique challenges faced by the Hispanic population, the company tailored its services to address language barriers, cultural nuances, and financial constraints.

Founded in [Masukkan Tahun Pendirian], Progreso Insurance quickly expanded its reach through strategic partnerships and community outreach programs. By establishing a strong presence in local neighborhoods and fostering trust with its clientele, the company solidified its position as a reliable insurance provider.

Core Values and Mission

At the heart of Progreso Insurance lies a set of core values that guide its operations and shape its interactions with customers. These values include:

- Integrity: Upholding ethical standards and maintaining transparency in all dealings.

- Customer Focus: Prioritizing the needs and satisfaction of customers above all else.

- Accessibility: Ensuring that insurance products and services are readily available to everyone, regardless of their background or financial status.

- Community Engagement: Actively participating in local communities and supporting initiatives that promote social and economic well-being.

The mission of Progreso Insurance is to empower individuals and families by providing them with the financial protection they need to navigate life’s uncertainties. By offering affordable insurance options and personalized support, the company aims to build long-term relationships with its customers and help them achieve their goals.

Products and Services

Progreso Insurance offers a range of insurance products designed to meet the diverse needs of its customers. These products include:

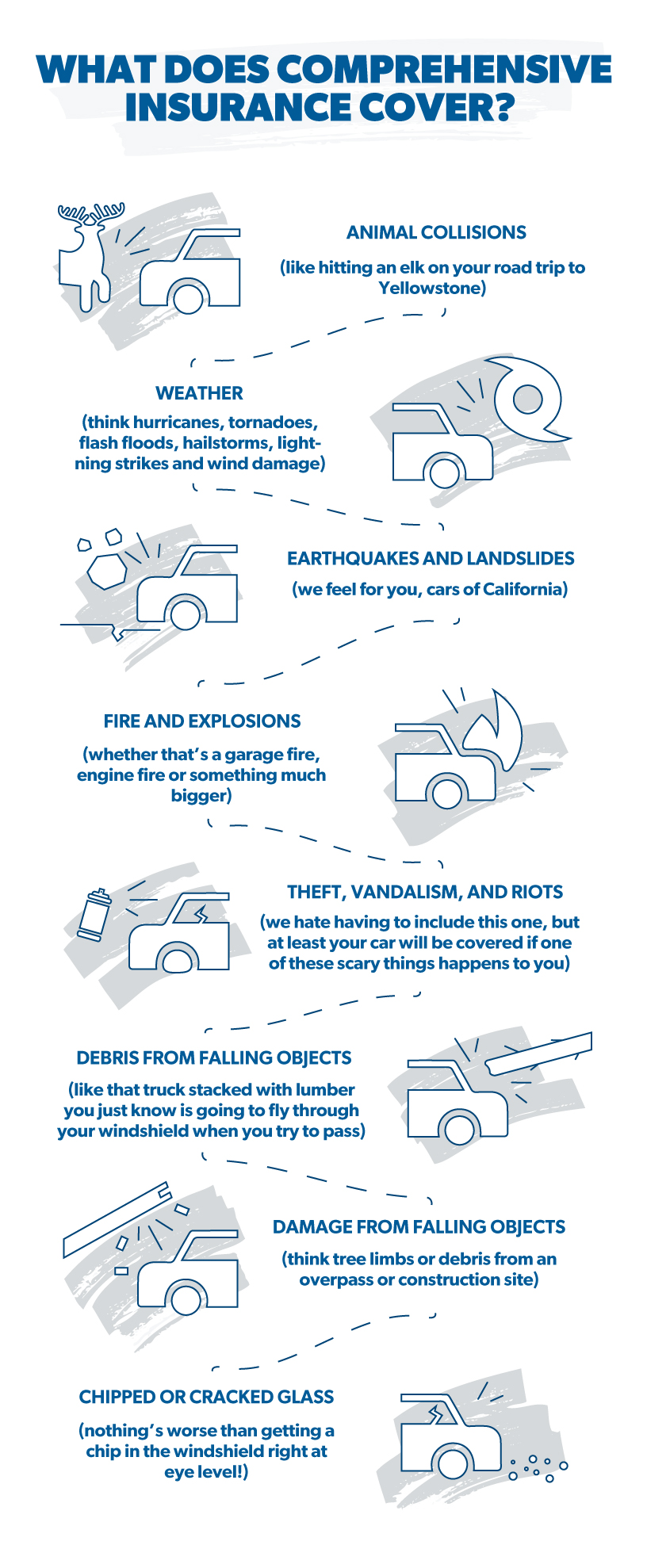

- Auto Insurance: Protecting drivers from financial losses resulting from accidents, theft, or damage to their vehicles. Progreso Insurance offers various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist protection.

- Homeowners Insurance: Safeguarding homeowners from financial losses due to fire, theft, vandalism, or natural disasters. Progreso Insurance provides coverage for the structure of the home, personal belongings, and liability protection.

- Renters Insurance: Protecting renters from financial losses due to theft, fire, or water damage to their personal belongings. Renters insurance also provides liability coverage in case someone is injured on the property.

- Commercial Auto Insurance: Providing coverage for businesses that use vehicles for commercial purposes. This insurance protects against financial losses resulting from accidents, theft, or damage to company vehicles.

- Other Insurance Products: In addition to the above, Progreso Insurance may also offer other insurance products such as life insurance, health insurance, and umbrella insurance.

Key Features and Benefits

Progreso Insurance distinguishes itself from its competitors through several key features and benefits:

- Affordable Rates: Progreso Insurance is committed to providing affordable insurance options to its customers. The company offers competitive rates and discounts to help customers save money on their insurance premiums.

- Flexible Payment Options: Progreso Insurance understands that customers have different financial situations. The company offers flexible payment options to accommodate their needs, including monthly payment plans and online payment options.

- Bilingual Service: Progreso Insurance recognizes the importance of providing service in both English and Spanish. The company has a team of bilingual agents who can assist customers with their insurance needs.

- Personalized Attention: Progreso Insurance is committed to providing personalized attention to each of its customers. The company’s agents take the time to understand their customers’ individual needs and provide them with customized insurance solutions.

- Easy Claims Process: Progreso Insurance makes it easy for customers to file a claim. The company has a dedicated claims department that is available to assist customers 24/7.

Customer Experience

Progreso Insurance places a strong emphasis on customer satisfaction. The company strives to provide a positive and seamless experience for its customers at every touchpoint.

- Online Resources: Progreso Insurance offers a comprehensive website with a wealth of information about its products and services. Customers can use the website to get a quote, file a claim, make a payment, or find an agent.

- Mobile App: Progreso Insurance has a mobile app that allows customers to access their insurance information on the go. Customers can use the app to view their policy documents, make a payment, file a claim, or contact customer service.

- Customer Service: Progreso Insurance has a dedicated customer service team that is available to assist customers with their insurance needs. The company’s customer service representatives are knowledgeable, friendly, and responsive.

- Community Involvement: Progreso Insurance is actively involved in the communities it serves. The company sponsors local events and supports community organizations.

Technology and Innovation

Progreso Insurance embraces technology and innovation to enhance its products, services, and customer experience.

- Online Quoting: Progreso Insurance offers an online quoting tool that allows customers to get a quick and easy quote for auto, home, or renters insurance.

- Digital Claims Processing: Progreso Insurance utilizes digital technology to streamline the claims process. Customers can file a claim online or through the mobile app, and the company uses digital tools to assess damages and process payments quickly and efficiently.

- Data Analytics: Progreso Insurance uses data analytics to identify trends and patterns in its customer base. This information is used to improve the company’s products, services, and marketing efforts.

- Artificial Intelligence: Progreso Insurance is exploring the use of artificial intelligence (AI) to improve customer service and streamline operations. For example, the company is using AI-powered chatbots to answer customer questions and provide support.

Community Impact

Progreso Insurance is committed to making a positive impact on the communities it serves. The company supports a variety of community initiatives, including:

- Financial Literacy Programs: Progreso Insurance partners with local organizations to provide financial literacy programs to underserved communities. These programs help individuals and families learn how to manage their money, save for the future, and protect themselves from financial risks.

- Scholarship Programs: Progreso Insurance offers scholarship programs to help students from underserved communities pursue their education. These scholarships provide financial assistance to help students pay for tuition, books, and other educational expenses.

- Disaster Relief Efforts: Progreso Insurance provides support to communities affected by natural disasters. The company donates money, supplies, and volunteer hours to help communities recover from disasters.

- Community Partnerships: Progreso Insurance partners with local organizations to support a variety of community initiatives. These partnerships help the company to reach more people and make a greater impact on the communities it serves.

Challenges and Opportunities

Like any insurance provider, Progreso Insurance faces challenges and opportunities in the ever-evolving market landscape.

- Competition: The insurance market is highly competitive, with numerous players vying for customers’ attention. Progreso Insurance must differentiate itself through its unique offerings, customer service, and community engagement.

- Regulatory Changes: The insurance industry is subject to regulatory changes that can impact the company’s operations and profitability. Progreso Insurance must stay informed about these changes and adapt its business practices accordingly.

- Technological Advancements: Technological advancements are transforming the insurance industry, creating both challenges and opportunities. Progreso Insurance must embrace technology to improve its products, services, and customer experience.

- Changing Demographics: The demographics of the United States are changing, with the Hispanic population growing rapidly. Progreso Insurance is well-positioned to serve this growing market, but it must continue to adapt its products and services to meet their needs.

- Economic Conditions: Economic conditions can impact the demand for insurance products. During economic downturns, people may be less likely to purchase insurance. Progreso Insurance must be prepared to weather economic storms and continue to provide affordable insurance options to its customers.

Future Outlook

The future of Progreso Insurance looks promising. The company is well-positioned to capitalize on the growing Hispanic market and its commitment to providing affordable insurance options and personalized service.

- Expansion: Progreso Insurance plans to expand its operations into new markets. The company is targeting states with large Hispanic populations and a need for affordable insurance options.

- Product Development: Progreso Insurance is constantly developing new products and services to meet the evolving needs of its customers. The company is exploring new technologies and partnerships to enhance its offerings.

- Community Engagement: Progreso Insurance will continue to invest in community engagement initiatives. The company believes that by supporting local communities, it can build stronger relationships with its customers and make a positive impact on society.

- Technological Innovation: Progreso Insurance will continue to embrace technology to improve its products, services, and customer experience. The company is exploring new ways to use technology to streamline operations, enhance customer service, and provide more affordable insurance options.

Conclusion

Progreso Insurance has established itself as a trusted provider of insurance solutions, particularly within the Hispanic community. Through its commitment to accessibility, affordability, and personalized service, the company has built a strong reputation for meeting the unique needs of its customers. By embracing technology, engaging with communities, and adapting to market trends, Progreso Insurance is poised for continued growth and success in the years to come. As it continues to evolve and expand its reach, Progreso Insurance will undoubtedly remain a vital resource for individuals and families seeking financial protection and peace of mind.