Okay, here’s a comprehensive article about insurance, aiming for approximately 2500 words. I’ve covered various aspects, from the basic definition to different types and key considerations.

Understanding Insurance: Protecting Yourself and Your Assets

In a world filled with uncertainties, insurance stands as a critical tool for managing risk and safeguarding your financial well-being. It’s a mechanism that transfers the financial burden of potential losses from an individual or entity to an insurance company in exchange for a premium. This article delves into the core concepts of insurance, exploring its various types, benefits, and essential considerations for making informed decisions.

What is Insurance?

At its heart, insurance is a contract, known as a policy, between an individual or entity (the policyholder) and an insurance company (the insurer). The policyholder pays a regular fee, called a premium, to the insurer. In return, the insurer agrees to compensate the policyholder for specific financial losses covered by the policy, should they occur. This compensation is typically in the form of a monetary payment, but it can also include services like repairs or replacements.

The fundamental principle behind insurance is risk pooling. Insurers collect premiums from a large number of policyholders, creating a pool of funds. This pool is then used to pay out claims to those who experience covered losses. Because the risk is spread across a large group, the financial impact of any single loss is significantly reduced for the individual.

Key Concepts in Insurance:

- Policyholder: The individual or entity who purchases the insurance policy and is entitled to its benefits.

- Insurer: The insurance company that provides coverage and pays out claims.

- Premium: The regular payment made by the policyholder to the insurer in exchange for coverage.

- Policy: The written contract between the policyholder and the insurer, outlining the terms and conditions of coverage.

- Coverage: The scope of protection provided by the insurance policy, specifying the types of losses that are covered.

- Deductible: The amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. A higher deductible typically results in a lower premium.

- Claim: A formal request made by the policyholder to the insurer for compensation for a covered loss.

- Risk: The possibility of a loss or harm occurring. Insurance helps mitigate financial risks.

- Indemnity: The principle that insurance aims to restore the policyholder to their financial position before the loss occurred, but not to profit from it.

- Exclusions: Specific events or circumstances that are not covered by the insurance policy. These are clearly defined in the policy document.

- Beneficiary: The person or entity designated to receive the benefits of a life insurance policy upon the death of the insured.

Types of Insurance:

Insurance comes in a wide variety of forms, each designed to protect against specific types of risks. Here are some of the most common types:

-

Health Insurance:

- Purpose: Covers medical expenses related to illness, injury, and preventative care.

- Coverage: Doctor visits, hospital stays, surgeries, prescription drugs, and other medical services.

- Types:

- Health Maintenance Organizations (HMOs): Typically require members to choose a primary care physician (PCP) who coordinates their care.

- Preferred Provider Organizations (PPOs): Allow members to see doctors and specialists without a referral, but may offer lower costs for using in-network providers.

- Point of Service (POS) Plans: Combine features of HMOs and PPOs, requiring a PCP but allowing out-of-network care with a referral.

- High-Deductible Health Plans (HDHPs): Feature lower premiums but higher deductibles, often paired with a Health Savings Account (HSA).

- Importance: Essential for managing potentially catastrophic medical costs and ensuring access to necessary healthcare.

-

Life Insurance:

- Purpose: Provides a financial benefit to beneficiaries upon the death of the insured.

- Coverage: A death benefit paid to the beneficiary, which can be used to cover funeral expenses, pay off debts, provide income replacement, or fund education.

- Types:

- Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, or 30 years). It’s generally more affordable than permanent life insurance.

- Whole Life Insurance: Provides lifelong coverage and includes a cash value component that grows over time.

- Universal Life Insurance: Offers more flexibility than whole life, allowing policyholders to adjust their premiums and death benefit within certain limits.

- Variable Life Insurance: Combines life insurance coverage with investment options, allowing the cash value to grow based on market performance.

- Importance: Provides financial security for loved ones in the event of the insured’s death, helping them cope with the financial burden of loss.

-

Auto Insurance:

- Purpose: Protects against financial losses resulting from car accidents, theft, or damage to a vehicle.

- Coverage:

- Liability Coverage: Pays for damages and injuries you cause to others in an accident.

- Collision Coverage: Pays for damage to your vehicle resulting from a collision with another vehicle or object.

- Comprehensive Coverage: Pays for damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in the accident (available in some states).

- Importance: Legally required in most states and provides essential financial protection in the event of an accident.

-

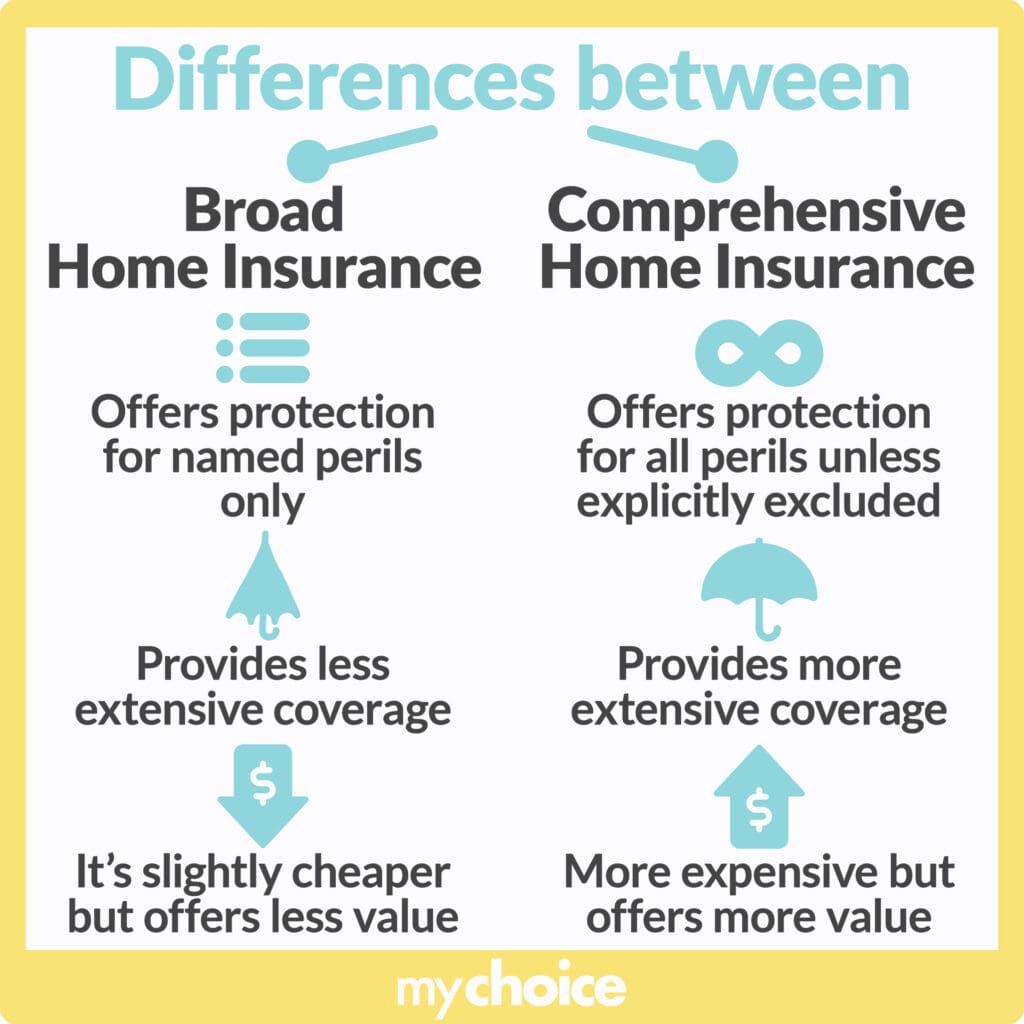

Homeowners Insurance:

- Purpose: Protects against financial losses resulting from damage to your home and its contents, as well as liability for injuries that occur on your property.

- Coverage:

- Dwelling Coverage: Pays for damage to the structure of your home.

- Personal Property Coverage: Pays for damage to or loss of your belongings, such as furniture, clothing, and electronics.

- Liability Coverage: Protects you if someone is injured on your property and sues you.

- Additional Living Expenses (ALE): Pays for temporary housing and other expenses if you’re unable to live in your home due to a covered loss.

- Importance: Protects your most valuable asset – your home – from a wide range of risks, including fire, theft, vandalism, and natural disasters.

-

Renters Insurance:

- Purpose: Protects renters against financial losses resulting from damage to their personal property, as well as liability for injuries that occur in their rented apartment or home.

- Coverage: Similar to homeowners insurance, but it doesn’t cover the structure of the building itself.

- Importance: Provides affordable protection for renters’ belongings and liability, offering peace of mind.

-

Disability Insurance:

- Purpose: Provides income replacement if you become disabled and are unable to work.

- Coverage: Pays a percentage of your pre-disability income, helping you cover living expenses while you’re unable to work.

- Types:

- Short-Term Disability Insurance: Provides benefits for a limited period, typically a few months.

- Long-Term Disability Insurance: Provides benefits for a longer period, potentially for several years or even until retirement.

- Importance: Protects your income and financial stability if you’re unable to work due to illness or injury.

-

Travel Insurance:

- Purpose: Protects against financial losses related to travel, such as trip cancellations, medical emergencies, lost luggage, and other unforeseen events.

- Coverage: Varies depending on the policy, but can include trip cancellation/interruption coverage, medical expense coverage, baggage loss/delay coverage, and emergency evacuation coverage.

- Importance: Provides peace of mind while traveling, ensuring you’re protected against unexpected events that could disrupt your trip and incur significant costs.

-

Business Insurance:

- Purpose: Protects businesses against a wide range of risks, including property damage, liability claims, and business interruption.

- Types:

- Commercial Property Insurance: Covers damage to business property, such as buildings, equipment, and inventory.

- General Liability Insurance: Protects against liability claims for bodily injury or property damage caused by the business’s operations.

- Business Interruption Insurance: Covers lost income and expenses if the business is forced to temporarily shut down due to a covered loss.

- Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees who are injured on the job.

- Professional Liability Insurance (Errors & Omissions Insurance): Protects professionals against liability claims for negligence or errors in their services.

- Importance: Essential for protecting businesses from potentially devastating financial losses that could threaten their survival.

Factors Affecting Insurance Premiums:

Several factors influence the cost of insurance premiums. Understanding these factors can help you make informed decisions and potentially lower your costs:

- Age: Younger drivers typically pay higher auto insurance premiums due to their higher risk of accidents. Life insurance premiums generally increase with age.

- Gender: In some cases, gender can affect insurance premiums. For example, men may pay more for auto insurance in certain age groups, while women may pay more for long-term care insurance.

- Health: Health insurance premiums are heavily influenced by your health status. Pre-existing conditions can affect coverage and cost. Life insurance premiums are also impacted by health factors.

- Location: Your location can affect insurance premiums due to factors such as crime rates, traffic density, and the risk of natural disasters.

- Driving Record: A history of accidents or traffic violations will significantly increase auto insurance premiums.

- Credit Score: In many states, insurers use credit scores to assess risk. A lower credit score can result in higher premiums.

- Deductible: Choosing a higher deductible will lower your premium, but it also means you’ll have to pay more out-of-pocket in the event of a claim.

- Coverage Limits: Higher coverage limits will result in higher premiums, but they also provide greater financial protection.

- Type of Vehicle: The make and model of your vehicle can affect auto insurance premiums. Expensive or high-performance vehicles typically cost more to insure.

- Occupation: Some occupations are considered higher risk and may result in higher insurance premiums.

- Lifestyle: Lifestyle factors, such as smoking or engaging in risky hobbies, can affect life insurance premiums.

Choosing the Right Insurance:

Selecting the right insurance policies requires careful consideration of your individual needs and circumstances. Here are some tips for making informed decisions:

- Assess Your Risks: Identify the potential risks you face and determine the types of insurance that are most important for protecting you and your assets.

- Shop Around: Get quotes from multiple insurance companies to compare prices and coverage options.

- Read the Policy Carefully: Before purchasing a policy, carefully review the terms and conditions, including the coverage limits, exclusions, and deductible.

- Consider Your Budget: Choose a policy that provides adequate coverage without straining your finances.

- Talk to an Insurance Professional: Consult with an insurance agent or broker to get personalized advice and guidance.

- Review Your Coverage Regularly: As your circumstances change, review your insurance policies to ensure they still meet your needs.

The Future of Insurance:

The insurance industry is constantly evolving, driven by technological advancements, changing demographics, and emerging risks. Some key trends shaping the future of insurance include:

- Digitalization: Insurers are increasingly using digital technologies to improve customer service, streamline processes, and develop new products.

- Data Analytics: Data analytics is being used to better assess risk, personalize pricing, and detect fraud.

- Artificial Intelligence (AI): AI is being used to automate tasks, improve claims processing, and provide personalized recommendations to customers.

- Insurtech: Innovative startups are disrupting the insurance industry with new technologies and business models.

- Climate Change: The increasing frequency and severity of extreme weather events are driving up insurance costs and forcing insurers to adapt their risk models.

- Cybersecurity: The growing threat of cyberattacks is creating a demand for cyber insurance to protect businesses from financial losses resulting from data breaches and other cyber incidents.

Conclusion:

Insurance is an essential tool for managing risk and protecting your financial well-being. By understanding the different types of insurance, the factors that affect premiums, and the key considerations for choosing the right policies, you can make informed decisions that provide peace of mind and financial security for yourself and your loved ones. Remember to regularly review your coverage to ensure it continues to meet your evolving needs in an ever-changing world.